A Weapon That Cuts Both Ways

Economic sanctions are often portrayed as a strategic tool—an alternative to military conflict, a way to pressure governments without bullets or bombs. But behind the policy rhetoric lies a complex web of ripple effects. Sanctions don’t just isolate governments; they reshape trade routes, unsettle markets, and leave businesses and consumers navigating the consequences.

What’s less talked about is the broader economic fallout—how sanctions fragment global trade, stifle growth, and sometimes miss their intended targets. In an interconnected world, restricting the flow of goods, services, and capital doesn’t happen in a vacuum. It reshapes everything from supply chains to commodity pricing to the stability of financial systems.

Who Imposes Sanctions—and Why

Sanctions are typically imposed by powerful nations or international coalitions like the United States, the European Union, or the United Nations. The goals vary: pressuring regimes over human rights violations, curbing nuclear ambitions, responding to territorial aggression, or influencing domestic policies abroad.

But the economic tools are often similar. These include trade restrictions, freezing of assets, travel bans, embargoes on specific goods (like oil, tech, or arms), or broader financial disconnection from global systems such as SWIFT.

While the intent is often political, the economic implications are deep and far-reaching.

Shocks to Global Supply Chains

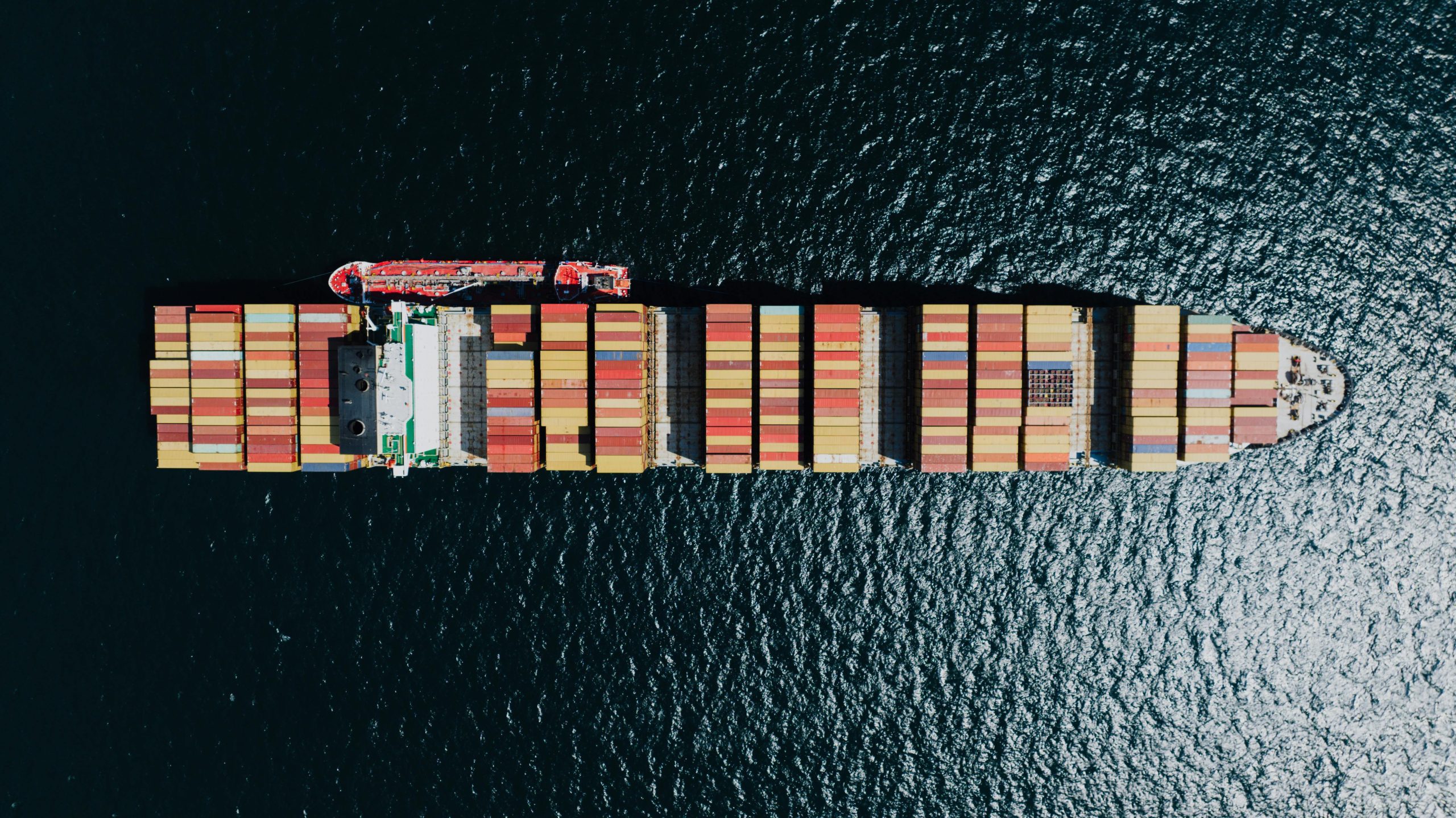

Modern trade relies on complex supply chains that stretch across continents. A single restriction can trigger cascading delays, inventory shortages, or force companies to find expensive workarounds.

Consider a scenario where a sanctioned country is a major exporter of rare earth minerals, grain, or oil. The effects aren’t just felt within that country—they hit global manufacturers, raise input costs, and sometimes halt production elsewhere. Sanctions on key technologies can also restrict access to components needed for cars, phones, and industrial equipment.

For global companies, sudden regulatory changes mean not only logistical headaches but also legal uncertainty and risk exposure. Some businesses may overcomply—cutting off ties beyond what’s required—just to avoid entanglement in legal grey zones.

Impact on Commodity Markets

Sanctions that touch natural resources, particularly energy, can cause serious market dislocation. Oil, gas, and grain markets are especially sensitive due to limited substitutes and long development timelines for alternatives.

When sanctions reduce supply, prices often spike. This benefits some producers in non-sanctioned countries but punishes importers and consumers worldwide. Poorer nations, dependent on imported energy or food, suffer the most as prices surge.

In response, countries often realign their trade partners. Sanctioned nations may turn to sympathetic or neutral states for buyers or suppliers, sometimes giving rise to shadow economies or alternative trade blocs that bypass Western influence.

Financial Sector Disruption

When sanctions target financial institutions, the impact can be just as serious. Restrictions on capital flows, access to international banks, or exclusion from payment systems isolate not only governments but also private businesses and individuals.

This fragmentation drives sanctioned countries to build parallel financial systems—sometimes with support from other global powers. In some cases, it accelerates the use of alternative currencies for trade or fuels demand for cryptocurrencies.

For global banks and insurers, this creates a climate of uncertainty and compliance fatigue. Financial institutions must navigate a patchwork of regulations, track sanctioned entities, and face reputational or legal risks for any misstep.

Collateral Damage on Third Parties

Sanctions rarely stay confined to two parties. Neighboring countries, regional trade hubs, and multinational firms with global reach often bear collateral damage. A freight company operating in sanctioned waters might face cargo delays. A business using dual-use goods (civilian and military applications) might get caught in overbroad restrictions.

Small economies dependent on trade with a sanctioned country can see downturns overnight. For example, a country relying on sanctioned oil exports for cheap fuel might face energy insecurity, inflation, or political instability.

This collateral impact can reduce goodwill toward sanctioning nations and create resistance in multilateral forums.

Sanctions Fatigue and Global Realignment

In recent years, the frequent use of sanctions has sparked concerns about overuse. Countries on the receiving end have started to develop strategies to insulate themselves—strengthening domestic industries, building non-Western alliances, and investing in alternative trade mechanisms.

This shift could lead to a more fragmented global economy, with parallel systems developing along political lines. If more countries hedge against Western sanctions by forming regional trade blocs or switching reserve currencies, long-standing global norms could weaken.

Meanwhile, for businesses, the increasing unpredictability of sanctions presents operational risk. Long-term investment decisions now must account not only for market dynamics but also for shifting geopolitical alliances.

Do Sanctions Work? The Long Debate

The effectiveness of sanctions is still debated. In some cases, they lead to negotiation, regime change, or policy reform. In others, they entrench authoritarianism, foster black markets, and harm civilians more than political elites.

The outcomes often depend on enforcement, multilateral coordination, and the economic resilience of the targeted country. When sanctions are widely supported, carefully targeted, and accompanied by diplomatic engagement, they are more likely to have a meaningful effect.

But broad sanctions with unclear objectives or weak enforcement may simply deepen suffering without achieving political change.

Rethinking Economic Pressure

As trade becomes more politicized, the global economy enters a new phase—one where national interests and values shape supply routes, investment decisions, and even currency systems. Sanctions are no longer just tools of punishment; they are instruments of a wider reshuffling of global power.

For economic policymakers, businesses, and consumers, the real cost of sanctions lies not just in trade disruptions, but in the erosion of trust, the rise of trade nationalism, and the shrinking space for global cooperation.

In this new landscape, the challenge isn’t only about imposing sanctions effectively. It’s about managing their long-term consequences—for everyone involved.