Understanding the Gig Economy

The gig economy is a labor market that revolves around short-term, flexible jobs rather than permanent, full-time positions. It encompasses a variety of roles, from freelance writers and graphic designers to drivers for rideshare companies and delivery services. With the advent of digital platforms like Uber, Airbnb, and Fiverr, this model of work has gained significant traction in recent years, reshaping the way people think about employment and income.

The appeal of the gig economy is clear: workers have the flexibility to choose when, where, and how much they work. However, the benefits of such flexibility often come at the cost of financial security and job stability. As more people turn to gig work for income, the debate continues: is the gig economy a pathway to greater independence and work-life balance, or does it expose workers to financial insecurity?

Flexibility: A Double-Edged Sword

One of the most touted benefits of the gig economy is flexibility. Gig workers are not bound by traditional office hours or fixed schedules. Instead, they can choose when and where to work, making it easier to balance work with personal life or pursue other interests and ventures. For many, this flexibility is a key motivator. Parents, students, and retirees, in particular, find the gig economy appealing as it allows them to earn money on their own terms.

However, this flexibility is not always as liberating as it seems. While the ability to work around other commitments is an advantage for some, it also means gig workers often face unpredictable work hours and earnings. Unlike traditional employees, gig workers do not have guaranteed hours or a set paycheck. Work may be plentiful one week and scarce the next, leaving workers in a constant state of financial uncertainty.

For example, a rideshare driver may find themselves working long hours in order to meet a financial goal, only to experience periods of slow demand where earnings are much lower than expected. Similarly, freelancers may face fluctuating workloads that leave them scrambling to find clients during lean periods. While flexibility is appealing, it also creates a level of unpredictability that traditional jobs do not.

Financial Insecurity: The Hidden Costs of Gig Work

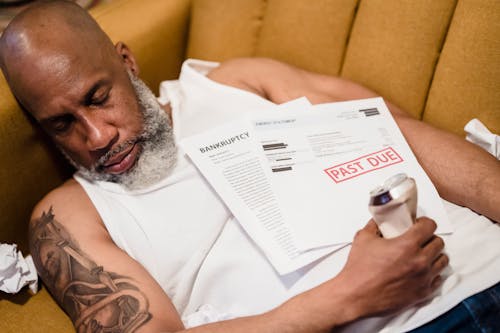

While gig work offers the opportunity for independence, it often comes with hidden costs. Unlike traditional employees, gig workers do not receive benefits such as health insurance, paid leave, retirement contributions, or workers’ compensation. In many cases, they are classified as independent contractors, which means they are responsible for their own taxes and benefits. This lack of a safety net can result in financial strain, particularly in times of illness, injury, or economic downturn.

For example, a gig worker who is unable to work due to a medical issue or family emergency has no paid sick leave or vacation days to fall back on. They must rely entirely on their savings or other sources of income, which can be difficult to manage, especially if they don’t have a stable financial cushion. Similarly, without employer-sponsored retirement plans, gig workers are left to manage their own retirement savings, which many may not have the knowledge or resources to do effectively.

Moreover, gig workers are often paid on a per-task basis, rather than receiving a fixed salary. This means that their income can vary significantly from week to week. While some may be able to earn a comfortable living, others may struggle to make ends meet, particularly if they do not have a steady stream of clients or work opportunities. For example, a freelance writer may find themselves working at full capacity for a few months, only to face a dry spell where writing opportunities are scarce. This lack of consistent income can make it challenging to budget, save, or plan for the future.

Lack of Job Security

Another major downside of the gig economy is the lack of job security. In traditional employment, workers typically have the reassurance of a regular paycheck, job stability, and the possibility of career advancement. In the gig economy, however, job security is minimal. Gig workers are often at the mercy of the platforms they work for, such as Uber or TaskRabbit, and can be easily replaced by others if demand for their services drops or if they fail to meet performance metrics.

Additionally, many gig workers face the constant threat of automation. With the rapid advancement of technology, many jobs that were once done by humans are now being taken over by machines. In the case of rideshare drivers, for example, the emergence of self-driving cars presents a potential threat to their livelihood. Similarly, many freelance writers and designers are competing with increasingly sophisticated AI tools that can produce content or design work at a fraction of the cost. This creates a sense of instability for gig workers, who are constantly forced to adapt to new technologies and market trends in order to stay competitive.

The Role of Technology in the Gig Economy

Technology plays a crucial role in the gig economy, as digital platforms connect workers with clients and customers. These platforms have made it easier than ever to find work, but they have also created new challenges for gig workers. For example, many gig workers rely on algorithms and rating systems to determine the value of their work. While these systems can help ensure a certain level of quality and efficiency, they can also be biased or flawed, leading to unfair compensation or negative ratings that can affect a worker’s ability to find future work.

Furthermore, some platforms charge workers fees or commissions for using their services, which can eat into their earnings. For example, rideshare drivers often have to share a percentage of their earnings with the platform, leaving them with less take-home pay. Similarly, freelancers on platforms like Upwork or Fiverr may face competition from workers in lower-wage countries, which can drive down prices and make it more difficult for them to secure high-paying gigs.

Despite these challenges, technology has undeniably made it easier for people to access gig work and find clients. However, it has also contributed to the precarious nature of the gig economy, as workers must constantly navigate shifting algorithms, fee structures, and market demand in order to stay afloat.

The Future of the Gig Economy

As the gig economy continues to grow, it remains to be seen how it will evolve. Some advocates argue that the rise of gig work represents a fundamental shift toward a more flexible and autonomous labor market, where workers are empowered to take control of their own careers and income. However, others caution that the gig economy exacerbates existing issues of income inequality, job insecurity, and lack of benefits, and may be unsustainable in the long term.

Governments and policymakers will need to address these issues if the gig economy is to thrive in a way that benefits both workers and employers. Some countries are already experimenting with new policies aimed at providing greater protections for gig workers, such as expanding access to benefits, improving job security, and ensuring fair compensation. However, finding a balance between flexibility and financial security remains a significant challenge.

Conclusion

The gig economy offers a level of flexibility that many workers find appealing, but it also brings significant risks and challenges. While some people thrive in this environment, enjoying the freedom to set their own schedules and choose their work, others face financial insecurity, job instability, and the lack of a safety net. As the gig economy continues to grow, it is essential to consider both the benefits and the downsides in order to create a fair and sustainable system for all workers involved.

Whether the gig economy represents a shift toward greater independence or a path to financial instability depends on how the challenges of this model are addressed. For now, gig workers must carefully weigh the promise of flexibility against the reality of financial uncertainty, knowing that the future of work is still very much in flux.